Macroeconomic situation in Russia. Aftersales market in recovery or stagnation? Categories: 2021, News Timelines: Russia, Russland

Announcement Date : 2 April 2021

For sure COVID-19 left a dramatic impact worldwide and particularly in Russia. 4.4 million people were infected year-to-date, and 2 months of isolation since March 2020 resulted in serious challenges for the whole economy and a change of consumer habits, resulting in new social trends going viral.

Now as we are at the end of the Q1 2021, our intention is to lend a helping hand in terms of analysis of official statistics. This analysis, combined with the assumptions we made at the end of 2020 about the outcome of the aftermarket allow us to build an expert opinion in regards to the plans for 2021.

GiPA has always supported our customers by proposing tools that allow to stand on firm ground in terms of deep and precise marketing analysis. Following our customer-oriented strategy, we have invested vast resources to the panel of the COVID-19 outcome, providing you with the figures of the turnover and seasonality changes of the workload, seasonality and the dynamics of the market recovery for all the sales channels and for the majority of the aftersales products. This approach is captured within Aftermarket Pulse: a product available as a part of ATO program, and available to purchase from non ATO customers.

The Russian automotive market and the aftersales sphere

Speaking of the Russian automotive market and the aftersales sphere, it is definitely worth mentioning that aside from COVID-19, at the start of 2020Russia faced a fall in oil prices and the household income. The state-regulated lockdown period started March 30th . Mileage was salvaged to some extent bylong trips to the southern regions. This resulted in a modest 9% drop of the aftersales market at the end of 2020. This is not the worst result comparing to the European market and signals to car and parts manufacturers that Russia is one of the most stable markets, despite an unprecedented year.

At the end of March, 2021 the data of the local official statistics is published and we can observe the beginning of the year and compare the figures to the pre-COVID period of 2020.

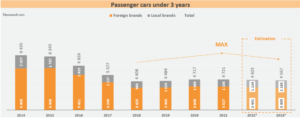

First of all, the new car sales are comparable to 2020, with January sales falling by 4% compared to January 2020. This will lower the amount of the guaranteed vehicles. The amount cars under 3-years age has reached it’s peak at the beginning of 2021 and will be stable but steadily decline over the next 3-years. That means that car manufacturers focus should move beyond the 0-2 years vehicles segment in order to keep the planned growth alongside the market. Following the market, the share of such cars and the operations for the guaranteed cars will only drop in the near future.

There is a clear focus of development of independent branded chains that have already reached the rate of services per 10,000 cars in the country comparing to the European countries but the fast-fit services linked to the OEM car manufacturers are almost non-existing and together with the online sales this gives a room for improvement for the aftersales. The major players in the branded IAMs market are FIT-service, Willgood, Bosch Service and others.They mostly belong to the large production and distribution chains and are focused on defending the sales channels of the investors, offering the franchisees very attractive business models compared to the private businesses.

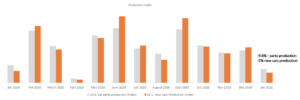

The next index we would like to touch on is the production of parts (-9.6% Jan 21 vs Jan 20) and the sale of new cars (-5% for the same period). The figures speak for themselves; the economy has not fully restored yet, reminding us that we are still in the crisis.

In planning the overall cash flow you must note that the inflation rate is higher than expected, the Central Bank has just raised the Key Funding rate to 4.5% (+0.25%) for the first since 2018 and this will balance the lack of the operations in the Q1 2021.

The highest peaks in terms of the turnover are expected at the end of May and September

In regards to the turnover, it is worth mentioning that the simplified taxation scheme designed for the middle-size business is not in place since the beginning of 2021 meaning that the vast majority of the OEMs and IAMs had to raise the prices on average by 7%. This is still lower than the amount of 20% VAT tax, and more inflation is expected.

One of the most interesting features of the Russian automotive market for the recent half of the year’s period is a strong deficit of the new cars as a result of lack of the appliances and the dealer’s interests which allows to gain additional margin not only for the aftersales but also for the new car sales as well as the high demand allows to add a lot of options and the prescribed guarantee programs as well.

The Russian market has suffered less than Central Europe

Generally speaking, the Russian market has suffered less than Central Europe, though 10% of the OES and IAMs couldn’t handle the lack of financial resources and the dropdown between March and June last year, and were forced to close the business.

The focus is being switched to the cars of 3-7 years of age, because they have the highest mileage and parts consumption.

As the champagne foam has settled down after the delayed demand and the long trips of Q2-Q3 2020, we are now face-to-face with the new mentality of the customers that have not become richer but the top 10% of the households that can still afford to change their car and are in line for the new cars with a limited budget looking for the cost-effective solutions.

The chains will make efforts to limit the number of parts brought directly from drivers from the internet but at the end of the day we’ll see the restoring market with the new portfolio of the customers and the channels as well. As the car parc will go down from 32.5 mln to 32.4 ,the growth in particular segments could be realised with a strong strategy based on the data analyzed together with the aftermarket professionals.