The Electric Shift: How EVs and New Mobility Models Are Reshaping the Automotive Industry Categories: 2025 Timelines: Argentina, Brazil, Central America, Chile, China, Colombia, France, Germany, India, Italy, Mexico, Morocco, Peru, Poland, Portugal, Spain, Thailand, Turkey, Vietnam

Announcement Date : 10 January 2025

The automotive landscape is undergoing a profound transformation. With a significant shift towards Battery Electric Vehicles (BEVs) and new mobility paradigms, the future of the car parc is increasingly electric. This article explores the drivers behind this change, the rise of Chinese brands in the EV market, and how mobility is evolving from ownership to diverse user-ship models.

Part 1: Electrification – The Future Is Here

1.1 The Shift to Electric

Europe’s transition towards electric mobility is accelerating, driven by favorable government policies, increased charging infrastructure, and a push for greener technologies. Norway, for instance, leads with BEV adoption, where electric vehicles have grown by 235% since 2016, signifying a strong shift away from internal combustion engines. According to GiPA, the Euro trends study further reveals that new BEV registrations across the EU5 have captured a significant market share, indicating the region’s commitment to sustainability. This rapid growth is expected to continue, with projections estimating that by 2035, over 45 million additional electric vehicles will be on European roads, reinforcing the EU’s vision for a greener automotive future.

1.2 Drivers’ Preferences and Adoption Trends

The rise of BEVs is largely driven by cost savings and environmental awareness. A considerable 76.5% of European respondents, as highlighted by GiPA’s studies, have pointed to reduced fuel expenses as a primary motivator. Additionally, lower maintenance costs and advanced technology of electric vehicles are significant factors drawing consumer interest. BEVs generally require less frequent visits to workshops, with longer intervals between maintenance, which translates into cost savings for owners. This has resonated well with various consumer segments, particularly younger, tech-savvy drivers who are inclined towards sustainable and innovative solutions.

1.3 The Role of Chinese Brands in the EV Market

Chinese automotive manufacturers are solidifying their presence in the European market, capitalizing on affordability and innovation. Recent data indicates that in the first nine months of 2024, over 150,000 Chinese-manufactured EVs were registered across Europe, representing a consistent rise compared to the previous year. This trend underscores the strategic push by Chinese automakers, which now include brands like Vinfast, BYD, Nio, and Link & Co., to capture market share with competitively priced and technologically advanced BEVs. According to GiPA, these brands’ ability to introduce feature-rich vehicles at lower costs has positioned them as serious competitors, challenging traditional European and American manufacturers.

1.4 Understanding Driver Behavior: Mileage and Usage

Driver behavior is also evolving, with a noticeable shift in how vehicles are used. GiPA recent data suggests that the average mileage driven per year has decreased across many regions, influenced by factors such as increased remote working, a surge in e-commerce, and changes in urban commuting patterns. In addition, BEV owners are more likely to use digital solutions and connectivity, driven by the promise of cost reductions and the convenience of seamless integration with smart technologies. This shift towards lower mileage and digital integration is redefining how aftermarket services are structured, pushing for efficiency and adaptability to meet the needs of modern drivers.

Part 2: The Evolution of Mobility – From Ownership to Usership

2.1 A Shift to Mobility as a Service (MaaS)

The concept of mobility is expanding beyond traditional car ownership. Increasing urbanization, environmental concerns, and the rise of the sharing economy are driving a shift towards user-ship models. Mobility as a Service (MaaS) solutions, such as car-sharing, ride-hailing platforms, and vehicle subscription services, are gaining traction. GiPA’s research indicates that companies like Yandex, BlaBlaCar, and Didi are leading this trend, providing flexible, on-demand mobility options that cater to urban populations. For city dwellers, especially, these services offer an affordable and sustainable alternative to car ownership, alleviating issues like parking, maintenance, and insurance.

2.2 New Mobility Solutions and Urban Adaptations

As cities adapt to this new mobility landscape, there is a growing emphasis on infrastructure that supports electric vehicles and shared mobility solutions. Investments in public charging stations and partnerships between local governments and private companies are facilitating this shift. GiPA’s presentation from the ATR Symposium highlights how major urban centers are redesigning their spaces to prioritize electric and shared mobility, with initiatives like expanded bicycle lanes, pedestrian zones, and dedicated EV charging hubs. This not only reduces emissions but also enhances the overall livability of cities, encouraging healthier, more sustainable urban lifestyles.

2.3 Implications for the Aftermarket

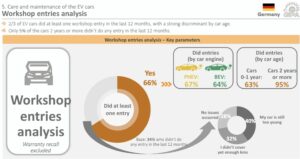

The rise of BEVs and shared mobility solutions presents both challenges and opportunities for the Independent Automotive Aftermarket (IAM). The need for specialized training and equipment for BEV maintenance, along with the integration of telematics, is reshaping service models. Many IAM networks have begun to offer services specifically tailored for EV maintenance and repairs, ensuring workshops are equipped to handle the unique requirements of electric vehicles. According to our last BEV Euro Trends survey in Germany, roughly two-thirds of EV owners had at least one workshop visit in the past 12 months, mostly for routine maintenance. This indicates a steady demand for regular upkeep, although the frequency is still lower than for traditional ICE vehicles, suggesting fewer wear-and-tear issues and a focus on efficiency

2.4 The Growing Importance of Data and Connectivity

As BEVs become more integrated with digital ecosystems, the role of data and connectivity is becoming increasingly crucial. Manufacturers are not only focusing on improving the technical specifications of electric vehicles but also on enhancing how users interact with these vehicles. According to GiPA’s insights, modern BEVs come equipped with advanced infotainment systems, seamless app integration, and even vehicle-to-grid (V2G) capabilities, which allow vehicles to interact with energy networks. This shift towards smarter, more connected vehicles is paving the way for new business models within the mobility sector, including subscription-based services for software updates, battery management, and enhanced safety features.

2.5 Charging Behavior and Infrastructure

The recent BEV Euro Trends survey in Germany provided insights into charging behavior, highlighting how drivers manage long-distance travel and daily use. The study showed that 61% of EV owners rely on navigation apps to plan their trips around available charging stations, reflecting the importance of reliable and accessible infrastructure. Furthermore, the majority of drivers, about 63%, charge their EVs at home, primarily using a wallbox, which indicates a preference for the convenience of home charging. For long trips, around 39% of BEV owners plan charging stops along the route, whereas some prefer switching to other vehicles, highlighting ongoing concerns about range and charging availability.

In conclusion

The automotive industry is at a pivotal moment, with electrification and diverse mobility solutions leading the charge. The continued growth of BEVs, driven by environmental consciousness, cost-efficiency, and technological advancements, is reshaping the market. Meanwhile, the evolution from ownership to user-ship models reflects broader societal trends towards flexibility and sustainability. As more drivers switch to electric and embrace flexible mobility models, the industry must adapt swiftly to these changes. The future is undoubtedly electric, and those prepared to innovate will be at the forefront of this transformation, shaping a greener, more connected world of mobility.